Crypto arbitrage can be an easy way to profit off of price differences on different cryptocurrency exchanges.

This guide covers the basics of cryptocurrency arbitrage trading — including how it works, the pros and cons, and the tools you can use to start arbitrage trading.

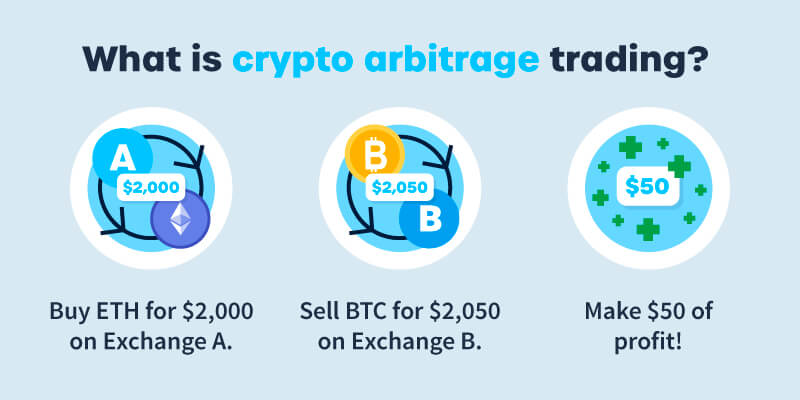

What is crypto arbitrage trading?

Each exchange has different levels of supply and demand for individual assets — which can lead to the same cryptocurrency being priced differently.

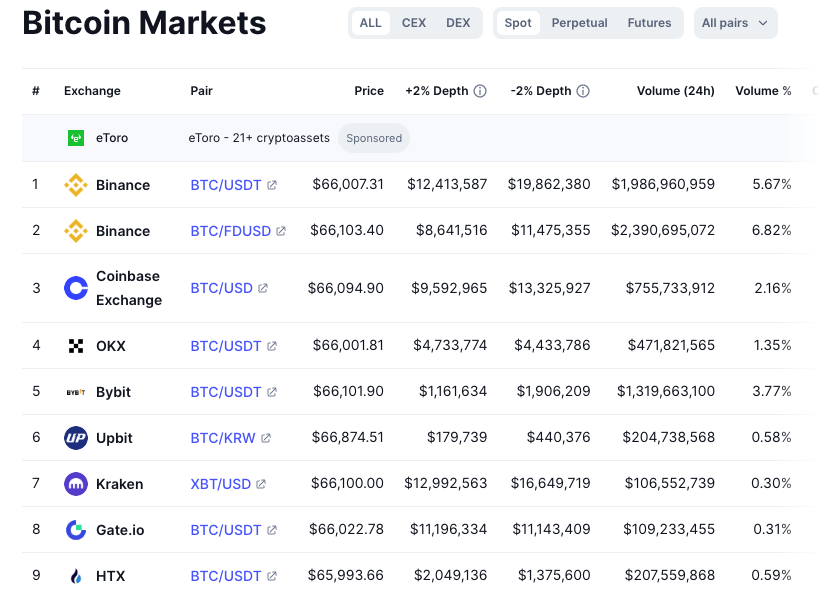

For example, let’s take a look at Coinmarketcap to see how Bitcoin is priced on different exchanges.

Crypto arbitrage involves taking advantage of these price discrepancies — for example, buying cryptocurrency on one exchange at a lower price and selling it on another exchange at a higher price.

Crypto arbitrage requires traders to act quickly, as these price discrepancies usually only last for a short time.

Does crypto arbitrage really work?

Successfully making profits from crypto arbitrage trading can be very difficult due to the high amount of competition and the speed needed to successfully execute a profitable trade.

Due to the difficulties involved with profitable crypto arbitrage trading, many successful traders are turning towards automated solutions.

Pros and cons of crypto arbitrage trading

Let’s walk through the pros and cons of crypto arbitrage trading.

Pros:

- Profit Potential: Arbitrage trading can lead to easy profits, especially if you’re using automated trading.

- Short-Term: Arbitrage trading typically involves buying and selling cryptocurrencies in a short period of time — meaning you eliminate the risk of your cryptocurrency losing value in the long-term.

Cons:

- High Competition: Successfully executing an arbitrage trade can be difficult due to the high number of traders looking to capitalize on the same opportunities.

- Transaction Costs: Fees and transaction times can reduce profit margins, and transaction delays can cancel out gains.

- Complexity: Arbitrage trading is an advanced strategy that requires time, effort, and knowledge of price tools. If you’re new to cryptocurrency, it’s a good idea to stay away from arbitrage trading for the time being.

What are the potential risks of arbitrage trading?

While arbitrage trading might seem simple, there are risks involved. Let’s walk through a couple:

- Market risk: Crypto markets are highly volatile, meaning that it’s possible that there will be a difference between the ‘expected’ price and the ‘actual’ price the trade is executed at.

- Liquidity risk: In some cases, your exchange might not have the liquidity needed to execute a trade.

How to get started with crypto arbitrage trading

Let’s walk through a step-by-step process to get started with crypto arbitrage trading.

- Set Up Your Accounts: You should create a cryptocurrency exchange account on multiple exchanges — including major exchanges like Coinbase, Kraken, and Gemini as well as smaller exchanges (which often have bigger price discrepancies).

- Monitor Prices: To identify crypto arbitrage trading opportunities, you’ll need to continuously monitor prices between different exchanges. You can use tools like CoinMarketCap to look at how cryptocurrencies are priced on different exchanges. You can also use crypto arbitrage scanners to automatically detect arbitrage opportunities (more on this later in the article).

- Execute Trades: Execute a trade quickly so that you can make a profit before your arbitrage opportunities disappear!

What Are the Types of Crypto Arbitrage Trading?

- Cross-exchange arbitrage: This is the most simple form of arbitrage. It involves buying cryptocurrency on one exchange, and selling it on another.

- Spatial arbitrage: Spatial arbitrage takes advantage of the different prices of cryptocurrencies in different geographical locations — for example, buying BTC on a US exchange and selling it on a Canadian exchange. Spatial arbitrage may be difficult to execute due to regulatory restrictions between countries.

- Triangular arbitrage: This strategy takes advantage of the price differences between three different trading pairs. For instance, you may trade Bitcoin for Ethereum, Ethereum for Litecoin, and Litecoin back to Bitcoin for a profit.

Automated trading in crypto arbitrage

Many crypto arbitrage traders rely on automated bots to carry out trades for them. Here are a few ways automated trading tools can help you:

- Price monitoring: Bots can take out the manual work of continuously tracking prices across crypto exchanges.

- Automatic trades: Automatically buy and sell cryptocurrencies when price discrepancies are detected.

- Speed: Bots operate faster than human traders, making them essential in high-speed arbitrage trading.

Best crypto arbitrage scanners

The following tools can make it easy to scan price discrepancies and find arbitrage trading opportunities:

CoinMarketCap: When you look up a cryptocurrency on CoinMarketCap, you’ll see its current price on multiple exchanges. While this option is completely free, it does take more manual work than some of the other alternatives listed.

ArbitrageScanner: The ArbitrageScanner sources data from 75+ centralized exchanges, 20+ decentralized exchanges, and 20+ blockchains, and gives you alerts when there is an arbitrage opportunity. ArbitrageScanner requires a paid subscription, and the cheapest plan currently costs $69 a month.

Cryptohopper: Cryptohopper offers AI-powered crypto trading bots, and can execute arbitrage trading strategies! Cryptohopper is available on a paid plan for about $24 a month.

In conclusion

While it may be hard to successfully execute a crypto arbitrage trade, price discrepancies between exchanges do present an opportunity for quick profit. If you’re getting started with arbitrage trading, it’s important to do your research, find the right tools, and understand the risks involved.

Frequently asked questions

- Is crypto arbitrage trading profitable?

Crypto arbitrage trading can be profitable, but is difficult due to the high amount of competition involved.

- Is crypto arbitrage illegal?

Crypto arbitrage trading through regulated exchanges is fully legal.

- Is crypto arbitrage still possible?

Making profits off of crypto arbitrage as a solo trader is very difficult. Many successful crypto arbitrage traders use automated tools to make a profit.

- Can you make a living off crypto arbitrage?

While crypto arbitrage trading can be a great way to supplement your income, it should not be relied upon as your primary source of income due to the risks involved.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

%20(1).png)

.png)