Berachain is a new cryptocurrency project gaining popularity in 2024. In this guide, we’ll break down everything you need to know about Berachain — including the history of the project, Berachain’s unique architecture, and some of the best applications in the Berachain ecosystem!

What is Berachain?

Berachain is a new layer-1 smart contract blockchain that aims to address some of the limitations found in existing blockchain networks like Ethereum and Solana.

Berachain leverages a novel consensus mechanism called Proof of Liquidity (PoL). The network’s unique architecture offers enhanced security and liquidity over the Proof of Stake consensus mechanism (more on this later).

Berachain is EVM-compatible, which means that you can port over assets from Ethereum and other EVM blockchains!

At the time of writing, Berachain is in testnet and has not officially launched!

History of Berachain

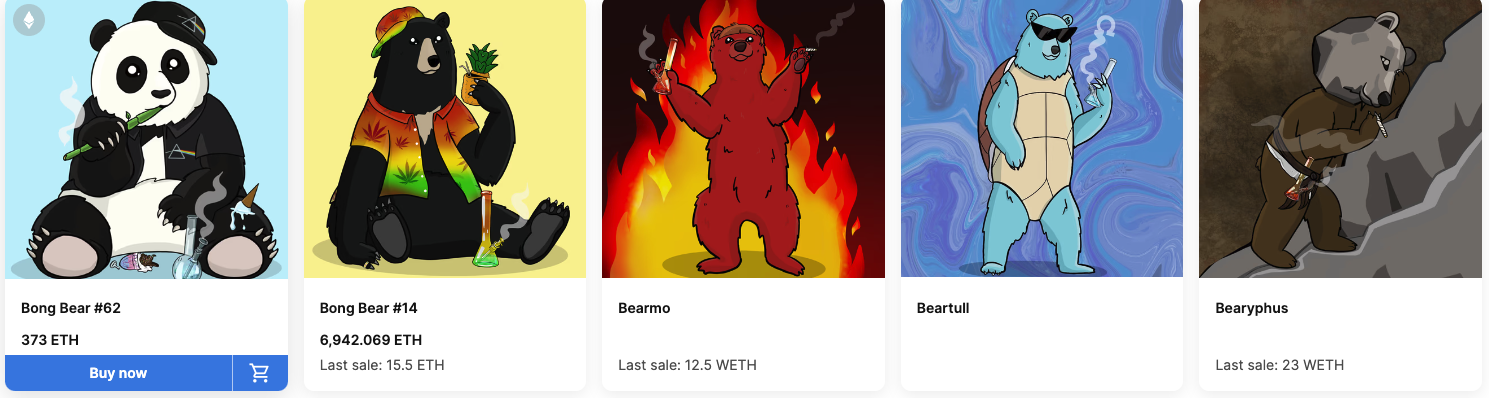

Berachain’s psuedo-anonymous founders — Papa and Smokey — created the NFT collection Bong Bears.

Bong Bears quickly became popular due to its unique features — such as its rebase mechanism that allowed existing users to get additional NFTs when new releases dropped!

The Bong Bears community attracted some of the top minds in the NFT and DeFi ecosystem — which inspired Bong Bear’s creators to create their own blockchain project: Berachain.

Berachain’s founders have continued to embrace Internet meme culture, even as the project has raised millions of dollars of investment. On April 20, 2023, Berachain announced that it had raised $42 million at a $420.69 million valuation. In April 2024, Berachain closed another round reported at $69 million — bringing the blockchain’s total valuation to $1.5 billion.

Who founded Berachain?

Berachain — like many other cryptocurrency projects — has a psuedo-anonymous founding team. At this time, the chain’s founders — Papa and Smokey — have not publicly revealed their identities.

Prospective investors of Berachain should note this fact with caution. Past founders of anonymous cryptocurrency projects have used anonymity as a tool to deceive individuals and shield themselves from future liability.

How does Berachain work?

Berachain uses a tri-token model.

- BERA: The primary token used for gas fees and transactions.

- BGT: The governance token used for staking and participating in the network's consensus. BGT cannot be bought on exchanges and can only be earned by participating in network security.

- HONEY: A stablecoin pegged to the US dollar. HONEY can be minted or earned through validator fees.

What is the advantage of Berachain’s tri-token model?

Berachain’s tri-token model may be an advantage over blockchains like Ethereum — where the same cryptocurrency is used for gas fees and staking.

The more ETH is staked, the lower the total supply of ETH available and the higher the cost of ETH. This means that paying gas fees on transactions is more expensive!

Berachain was designed specifically to solve this problem. Because BERA and BGT are separate tokens, staked cryptocurrency does not impact the total supply of cryptocurrency available for transactions.

With Berachain’s unique tri-token model, users can stake cryptocurrency and contribute to the security of the network without raising gas fees!

Proof of Liquidity Consensus Model

To better understand Proof of Stake and Proof of Liquidity, let’s break down the difference between the two consensus mechanisms.

- Proof of Stake (PoS): Proof of stake chains like Ethereum allow validators to earn ETH by staking directly with the blockchain. Existing holders of ETH will continue to earn more ETH — which could lead to Ethereum becoming more centralized over time!

- Proof of Liquidity (PoL): Proof of liquidity chains like Berachain allow participants to provide liquidity. In return, liquidity providers are rewarded with BGT. This setup allows more liquidity for the Berachain ecosystem and less centralization risk!

In the future, decentralized applications built on Berachain will be able to create liquidity pools to contribute to network security. That means independent developers have the opportunity to receive funds from validators — potentially super-charging applications across the Berachain ecosystem!

What decentralized applications are available on Berachain?

Let’s walk through some decentralized protocols available on Berachain.

- Berachain BEX: Berachain BEX is a decentralized exchange built on the Berachain network! The exchange allows users to buy and sell tokens, provide liquidity, and earn BGT rewards for providing liquidity.

- Boink: Boink is a cryptocurrency game that allows you to earn rewards in BERA by competing with other players!

- Apiarist Finance: A DeFi protocol that offers cheap yield farming, staking, and lending services!

Ethereum vs. Berachain

Ethereum Pros

- First-mover advantage: As the first smart contract blockchain on the market, Ethereum benefits from first-mover advantage. Many of the world’s most popular NFTs and decentralized apps are built on the Ethereum network.

- Battle tested: Ethereum has supported millions of users and thousands of applications since 2014. The network is battle-tested and is trusted by entrepreneurs and developers.

- Established network: While Berachain is a relatively new blockchain, Ethereum has survived multiple crypto bear markets. That means that many traders see investing in ETH as less risky than investing in newer cryptocurrencies like BERA.

Berachain Pros

- Unique structure: Berachain’s unique Proof of Liquidity consensus mechanism may give it an advantage over Ethereum’s traditional Proof of Stake.

- Growth potential: As a newer blockchain, Berachain may have more growth potential than Ethereum.

- EVM-compatible: Unlike other Ethereum competitors like Solana, Berachain is EVM compatible.

How to Get BERA

At this time, BERA is not available through most popular exchanges. According to the Berachain team, it’s likely that BERA will be available to buy, sell, and trade on exchanges in the future.

On the other hand, BGT can only be obtained by participating in network security.

Users can obtain BERA tokens for free through faucets, which distribute small amounts of the token to build user engagement for the network.

What is the Berachain Airdrop?

The Berachain testnet is currently live and available for the public!

It’s likely that if you use the Berachain testnet, you’ll be eligible to receive a BERA airdrop when the mainnet launches in 2024!

How is Berachain taxed?

Like other cryptocurrencies, Berachain is subject to capital gains tax and income tax.

If you earn BERA through a crypto faucet or an airdrop, you’ll recognize income based on its fair market value at the time of receipt.

In conclusion

Despite the fact that Berachain hasn’t been officially launched, the project has already attracted significant investment and an active community. This combined with the network’s unique Proof of Liquidity consensus mechanism could give Berachain an edge over existing smart contract blockchains.

Any prospective investors should be cautious, as most new cryptocurrency project go to zero.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

%20(1).png)

.png)