Key Takeaways

- Market capitalization shows the total value of a cryptocurrency.

- While large-cap cryptocurrencies are more established, small-cap cryptos have higher risk and potentially higher reward.

What is Market Cap in Crypto?

Crypto market capitalization (market cap) is the total value of a digital currency.

You can calculate crypto market cap through the following formula:

Market Cap = Price of a single coin x number of coins in circulation

For example, if a cryptocurrency has 1 million coins in circulation and each coin is worth $50, the market cap is $50 million.

Newer investors often look at the price of a cryptocurrency to determine the overall value of the project. However, market cap is a much better indicator since it accounts for supply!

Why is market cap important?

Market cap can give interested investors important information about a cryptocurrency.

Large market cap = Lower risk, lower reward: A higher market cap generally indicates a more established and stable project.

Small market cap = High risk, high reward: Lower market cap suggests a more volatile and potentially high-growth investment opportunity. While lower market cap coins are typically riskier, they have a better chance of increasing in value.

What are the different types of market cap categories?

Cryptocurrencies are often categorized into three categories based on their market cap:

- Large-cap: Large-cap cryptocurrencies have a market cap over $10 billion. These cryptocurrencies — like BTC and ETH — are typically more established and less volatile than their smaller counterparts.

- Mid-cap: Between $1 billion and $10 billion. These cryptocurrencies can offer a balance between growth potential and risk.

- Small-cap: Under $1 billion. These cryptocurrencies are highly volatile and are considered riskier, but can offer high growth!

Why do smaller market cap coins have higher growth potential?

Let’s take a closer look at why small cap cryptocurrencies have higher growth potential.

Imagine a coin with a market capitalization of $500 million. If its market cap increases to $2 billion, its price will go up by 4x!

Typically, it’s much harder for established cryptocurrencies to increase by such a large magnitude, since their market capitalizations are already very high.

However, it’s important to note that small-cap cryptocurrencies are usually very new and do not have a large, established user base. As a result, these cryptocurrencies often have a higher chance of losing their value entirely.

What are the limitations of crypto market cap?

Cryptocurrency market cap is just one factor you should be considering when analyzing the risk and growth potential of a project.

You should also consider other fundamentals that may impact price, including the following:

- Tokenomics: The current token supply of the project, and the expected supply in the future.

- Use cases: The potential use cases of a cryptocurrency can determine its demand.

- User base: The current number of active users for the project.

How does market cap impact crypto price?

The market cap of a cryptocurrency can impact its liquidity and its susceptibility to price manipulation.

How does market cap impact liquidity and market manipulation?

Small-cap cryptocurrencies: Small-cap cryptocurrencies have low liquidity and more susceptibility to price manipulation.

- Low liquidity: Small-cap cryptocurrencies can be harder to buy and sell on most cryptocurrency exchanges — which means they have higher volatility. Because the total amount of transactions is lower, a smaller volume of transactions can change the price of the asset significantly.

- Susceptible to price manipulation: Because small-cryptocurrencies are less valuable, ‘cryptocurrency whales’ — high net-worth crypto investors — have more power to move the price of these coins.

Large-cap cryptocurrencies: Large-cap cryptocurrencies typically have high liquidity and less susceptibility to price manipulation.

- High liquidity: Most large-cap cryptocurrencies are available to trade on most major exchanges and have high trade volume. That means they typically see less volatility than small-cap cryptocurrencies.

- Harder to manipulate price: Because large-cap cryptocurrencies are more valuable, it’s harder for any one individual to manipulate their prices.

Tips for considering market cap when investing

Remember there is no ‘good’ market cap: What a ‘good’ market cap is depends on what type of investment you are looking for. Remember, a smaller-cap cryptocurrency typically comes with higher risk and higher growth potential.

Diversify your portfolio: Diversifying across different market caps can help you build a balanced portfolio. Some investors choose to diversify across large-cap, mid-cap, and small-cap cryptocurrencies to balance stability with growth potential.

Keep in mind your time horizon: Keep in mind your time horizon when you make your investment decisions. Typically, long-term investors can take on more risk, and can potentially benefit more from small and mid-cap cryptocurrencies that may take years to grow substantially in value.

What is fully diluted market cap?

Fully diluted market cap considers the total value of a cryptocurrency if all possible coins were in circulation — including coins that have not yet been mined or distributed.

What are the pros of looking at fully diluted market cap?: Fully diluted market cap can provide a more comprehensive view of a cryptocurrency's potential market value.

What are the cons of looking at fully diluted market cap?: Critics argue that fully diluted market cap can be misleading, since it assumes that the project would be priced the same even if supply increased.

Why does market cap fluctuate:

The cryptocurrency market is highly volatile, and the market cap of a cryptocurrency can fluctuate wildly in a short period of time due to changes in supply and demand. Here are a few factors that can impact market cap:

- Market sentiment

- Regulatory news

- News pertaining to a specific project

- Macroeconomic factors

- An increase in the supply of that specific cryptocurrency

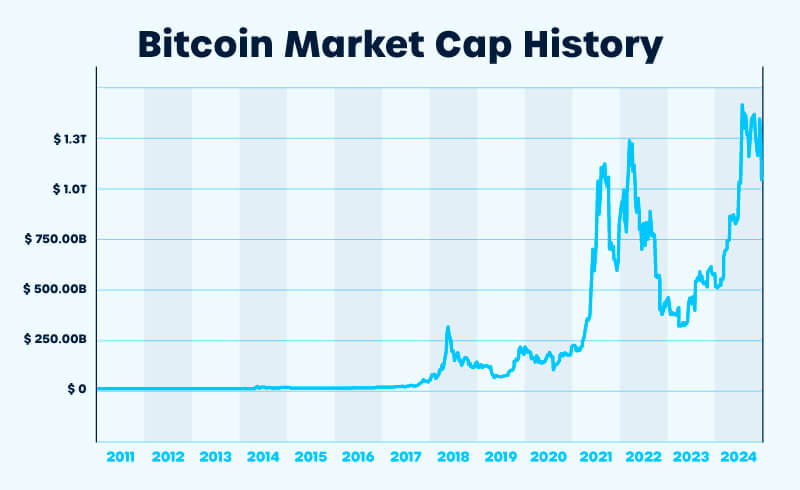

Bitcoin: Market Cap Analysis over Time

Let’s take a look at Bitcoin’s market capitalization over time.

As you can see, market cap — even for established cryptocurrencies like BTC — can fluctuate significantly based on whether cryptocurrency is in a bull or bear market.

It’s important to note that despite the volatility, Bitcoin’s price has consistently gone up over time. Ultimately, projects with strong fundamentals are able to survive bear markets and grow over time.

Conclusion

Market capitalization is one of the most important metrics to look at for any cryptocurrency. By keeping market cap in mind for all of your crypto investments, you can build a portfolio that balances risk and growth potential.

Frequently asked questions

- How does market cap work?

Market cap is the total value of a cryptocurrency. You can calculate market cap by multiplying the current price of a cryptocurrency by its total circulating supply.

- Is a higher market cap better?

A higher market cap often indicates a more stable and established cryptocurrency, but it doesn't guarantee better returns for the future.

- Is low market cap bad in crypto?

A low market cap can indicate higher risk and volatility, but can also signal the potential for higher returns.

- How much market cap is good for crypto?

There is no definitive answer on what market cap is ‘good’. Large-cap cryptocurrencies are typically safer, while small-cap cryptocurrencies typically have higher risk and higher growth potential.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

%20(1).png)

.png)