Key Takeaways

- Form 1099-B is issued by exchanges to help report capital gains and losses. At this time, most cryptocurrency exchanges don’t send this form to customers.

- Starting in the 2025 tax year, all exchanges operating in the United States will be required to report capital gains and losses to the IRS.

Form 1099-B can make it easy to report your cryptocurrency capital gains — but it may contain inaccurate or incomplete information about your tax liability.

In this guide, we’ll cover everything you need to know about Form 1099-B for cryptocurrency taxes. We’ll explain what you should do if you receive Form 1099-B and and discuss why 1099 forms can lead to tax reporting issues for crypto investors.

Do I have to report crypto on my taxes?

Cryptocurrency is considered property by the IRS and is subject to capital gains and ordinary income tax.

.jpeg)

For more information, check out our comprehensive guide to cryptocurrency taxes.

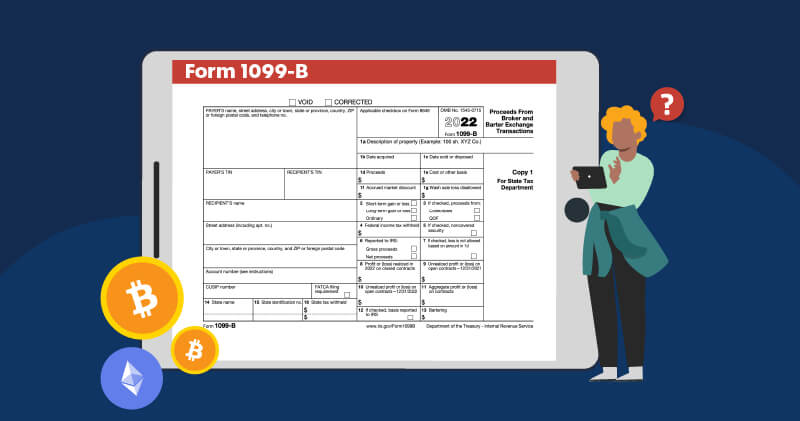

What is Form 1099-B?

Form 1099-B is a tax form designed to track the disposals of capital assets. The form contains details about cost basis, gross proceeds, and capital gains and losses.

Stockbrokers like Robinhood and eTrade typically send out 1099-Bs for your stock trading activity at the end of the year. Like other 1099 forms, Form 1099-B is issued to both the individual taxpayer and the IRS.

At this time, cryptocurrency exchanges are not required to send 1099-Bs to customers.

Do you get a 1099-B for cryptocurrency?

While some exchanges choose to issue Form 1099-B, most exchanges do not send tax forms detailing capital gains and losses.

This will change in the near future. Due to the Build Back Better Act, cryptocurrency brokers will be required to report capital gains and losses to customers and the IRS through Form 1099-DA starting in the 2025 tax year. This form is specifically designed to help taxpayers report gains and losses from digital assets.

What tax forms should I receive from cryptocurrency exchanges?

Cryptocurrency exchanges may send you other versions of Form 1099 — such as Form 1099-MISC, Form 1099-K,and Form 1099-DA.

Does Coinbase issue Form 1099-B?

Like other major exchanges, Coinbase currently does not issue Form 1099-B to customers and the IRS. For more information, check out our guide: Does Coinbase Report to the IRS?

Which exchanges issue 1099-B?

Here are some popular exchanges that issued Form 1099-B to customers for the 2023 tax year.

- Cash App

- Crypto.com (for contract trading only)

- Robinhood

- Uphold

Do I need to include 1099-B on my tax return?

There’s no need to attach Form 1099-B on your tax return, but you can use the information on the form to keep track of your capital gains and losses.

What happens if I don’t report 1099-B income to the IRS?

If you don’t report taxable income that’s been reported to the IRS on Form 1099-B, it’s likely that your tax return will be flagged automatically and you will be sent a warning letter about your unpaid tax liability.

Remember, all of your cryptocurrency disposals and income are required to be reported regardless of whether you receive a 1099 form. The IRS can often track your cryptocurrency transactions even if they are not mentioned on these tax forms.

How do I report cryptocurrency disposals?

All cryptocurrency disposals (including those reported on a 1099-B) should be reported on Form 8949, along with a description of the property, your cost basis and gross proceeds, and the date you acquired and disposed of your assets.

For more information, check out our guide to reporting your cryptocurrency taxes.

What happens if I didn’t get a 1099-B from my exchange?

You are required to report all your taxable transactions to the IRS regardless of whether your exchange sends relevant tax forms. Failure to do so is considered tax fraud.

Which crypto exchanges do not report to the IRS?

At this time, decentralized exchanges like Uniswap do not issue Form 1099-B or other tax forms to the IRS. However, Form 1099-DA reporting requirements will apply to decentralized exchanges starting in the 2025 tax year.

Remember, you should report all of your taxable income on your tax return. Not reporting your cryptocurrency income on your tax return can lead to fines, audits, and even potential jail time.

For more information, check out our guide to non-KYC exchanges.

Why does my Form 1099-B have incomplete/inaccurate information?

Transfers between different exchanges and wallets can lead to inaccuracies on Form 1099-B. In these situations, your cryptocurrency exchange might not have data on cost basis that’s needed to calculate your capital gains and losses.

For example, consider the following scenario.

.jpeg)

In this case, David should incur a capital gain of $5,000. But because Exchange B doesn’t know David’s original cost basis, it may report his cost basis as ‘n/a’ or ‘$0’ on his Form 1099-B.

If David cannot prove that he originally bought his Bitcoin for $10,000, he might be on the hook for $15,000 of capital gain.

Unfortunately, this issue is present with other types of 1099 forms as well — including the soon-to-be mandatory Form 1099-DA. Once reporting requirements go into effect, it’s likely that many crypto investors will receive tax forms with inaccurate or misleading information.

To keep accurate records of your crypto transactions, you can use crypto tax software like CoinLedger to track your cost basis across multiple exchanges and wallets.

How can CoinLedger help me track my cost basis?

When you connect your wallets and exchanges to CoinLedger, the platform can connect to your wallets and exchanges and generate a comprehensive tax form in minutes!

- Connect your wallets and exchanges to CoinLedger.

- Double check your transactions!

- Generate a crypto tax form!

Your tax form includes a complete record of your cost basis and capital gains for your crypto transactions!

Report your capital gains and losses with CoinLedger

Want to report your gains and losses before the tax deadline? CoinLedger can help.

There’s no need to track your transactions manually on a spreadsheet — simply connect your wallets and let the platform do the work. With automatic integrations to exchanges like Coinbase, Kraken, Gemini and wallets like MetaMask, it’s never been easier to file your crypto taxes.

More than 500,000 investors use CoinLedger to generate comprehensive tax reports in minutes.

Frequently asked questions

- Is crypto reported on 1099-B?

At this time, cryptocurrency is not required to be reported on Form 1099-B and similar tax forms. Starting in the 2025 tax year, capital gains and losses from crypto will be reported on Form 1099-DA.

- How do I get a 1099-B for crypto?

If your exchange doesn’t issue Form 1099-B, you will not receive one. It’s important to remember that you do not need Form 1099-B to report your cryptocurrency taxes.

- Will I get a 1099-B from Coinbase?

At this time, Coinbase does not issue Form 1099-B to customers.

- What is 1099-B used for?

Form 1099-B is designed for brokers to report capital gains and losses to customers and the IRS.

- How do I report crypto without Form 1099-B?

If you haven’t received Form 1099-B, you can calculate your gains and losses manually by tracking your crypto transaction history through a spreadsheet or automatically with a crypto tax calculator like CoinLedger.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)